2024-25 FAFSA Changes

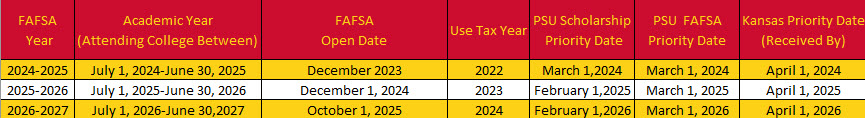

Important FAFSA Dates

To learn more about FAFSA, Loans, GUS, and Scholarships, go to Financial Aid Helpful Links

Update 04/16/24

The Department of Education is now allowing students to make corrections to their 2024-25 FAFSA. They will be notifying students that action needs to be taken on their FAFSA via email. If you had trouble signing or submitting your FAFSA please visit Instructions on correcting your 2024-25 FAFSA You can also login to your 2024-25 FAFSA using your FSA ID and it will tell you what action needs to be done.

Update 12/18/23

The Department of Education announced a soft launch of the 2024-25 FAFSA application to monitor and address potential issues before and after December 31. During this period, users can access the form, and there's no rush to submit as Institutional Student Information Records (ISIRs) won't be sent to schools until later in January. Anticipating high volumes, a waiting room feature will control web traffic. After completing the form, applicants receive a confirmation email with an estimated Student Aid Index and Pell Grant eligibility. The notice addresses potential issues during maintenance and emphasizes the importance of clear communication amid concerns from lawmakers and the education community.

Changes coming to the 2024-25 FAFSA *updated 04/16/24

2024-25 FAFSA Opening Later

FAFSA will open sometime around December 2023 for the 2024-25 Academic Year. Please pay attention to your emails and campus notifications for specifics to when 2024-25 FAFSA will open. Additionally, pay close attention to any other state or scholarship deadlines.

All Contributors Must Create an FSA ID

Everyone who is a contributor on the FAFSA form must create a separate FSA ID and password to access and complete the online FAFSA form. Contributors who don’t have a social security number can still create a studentaid.gov account to fill out their sections on the FAFSA form.

Additionally, everyone using their FSA ID for the 2024-25 FAFSA will need to go through a two-step verification process. When setting up your FSA ID, use email, text, or authentication apps for added security. This means students and their parents/spouses should communicate if they're helping with different roles in filling out the FAFSA.

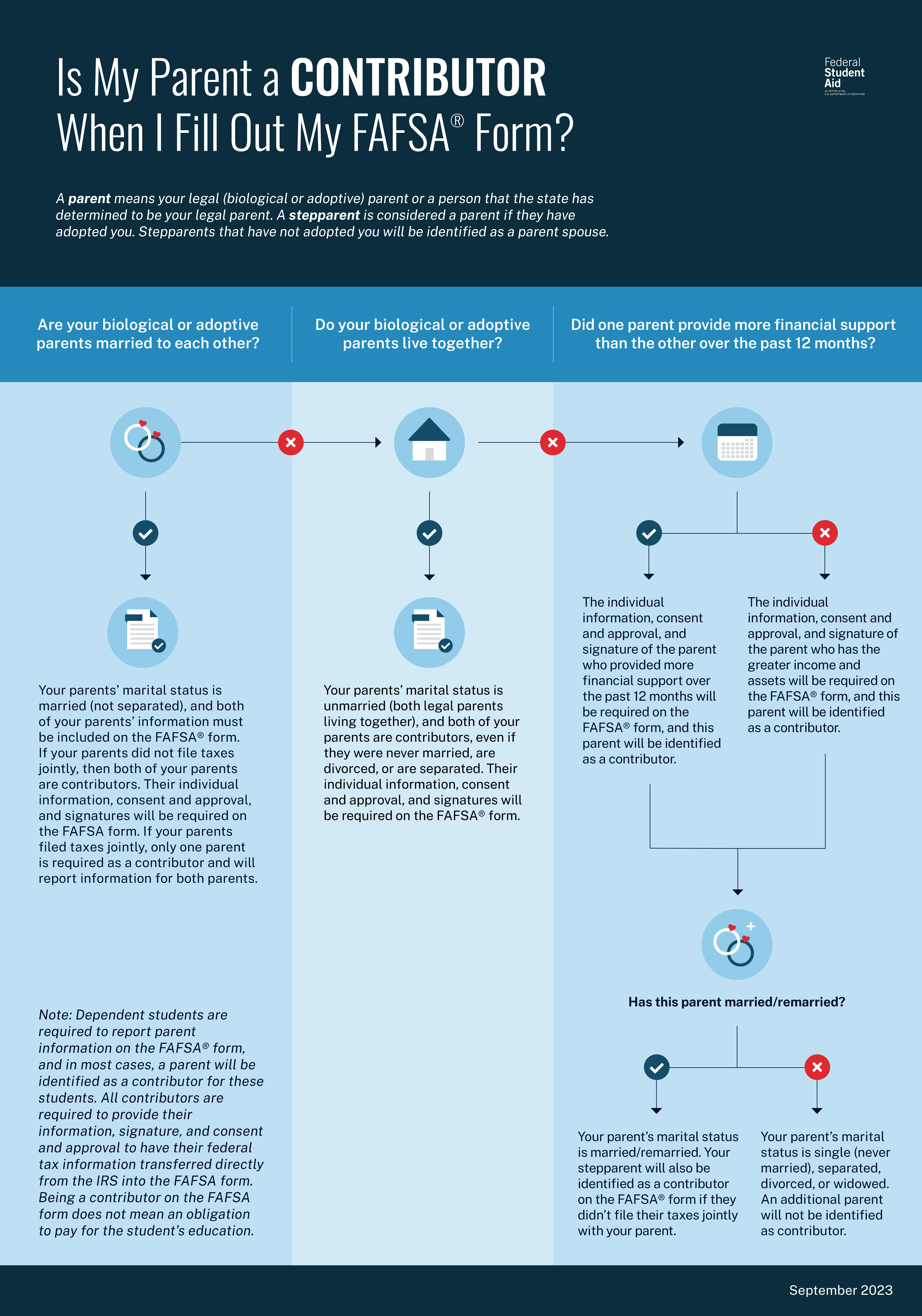

Who are Contributors on the FAFSA

Contributor: any individual required to provide consent and approval for federal tax information (FTI) along with their signature on the FAFSA® form, including the student; the student’s spouse; a biological or adoptive parent; or the parent’s spouse (stepparent).

EFC is Going Away and Being Replaced by SAI

Student Aid Index (SAI): replaces the Expected Family Contribution (EFC) as a formal evaluation of a student’s approximate financial resources to contribute toward their postsecondary education for a specific award year.

FAFSA Will Be Available in More Languages

The 2024-25 application will now be available in 11 of the most common languages spoken in the United States.

Fewer Questions on the FAFSA

The new FAFSA will be streamlined, reducing the amount of questions being asked from 108 previously to 46 or less with the new simplified FAFSA.

Mandatory Use of IRS Direct Data Exchange

Starting in 2024-25, all contributors on the FAFSA must consent to the Department of Education receiving tax information or confirmation of non-filing status directly from the IRS. This change simplifies the FAFSA process for most applicants. Consent and approval for the transfer of federal tax information are required to be eligible for federal student aid. Even if one of your contributors does not have a social security number, did not file taxes, or filed taxes outside of the U.S., consent and approval are still required.

Automatic Pell Grant Awards for Some

Families below certain income levels will automatically qualify for Pell Grants, streamlining the aid distribution process.

Inclusion of Family Farms and Small Businesses as Reportable Assets

There are significant changes to the asset contribution components in the SAI formula.

- The net worth of a business is no longer limited to those with more than 100 full-time employees. Applicants will be asked to report the net worth of all businesses, regardless of the size of the business.

- Net worth of a farm now includes the value of a family farm. However, the value of a family’s primary residence is still excluded. The net worth of a farm may include the fair market value of land, buildings, livestock, unharvested crops, and machinery actively used in investment farms or agricultural or commercial activities, minus any debts held against those assets.

Number of Family Members in College is No Longer Considered in the Need Analysis

The number of family members in college is no longer a factor in the need analysis. Schools may use professional judgment to adjust other data items related to COA or SAI that reflect costs associated with additional family members enrolled in college.

Why is the FAFSA changing?

The FAFSA Simplification Act passed on Dec. 27, 2020 as part of the Consolidated Appropriations Act, 2021 and represents a significant overhaul of federal student aid, including the Free Application for Federal Student Aid (FAFSA®) form, need analysis, and many policies and procedures for schools that participate in the Title IV programs. FSA will be implementing the FAFSA Simplification Act alongside the FAFSA portion of the Fostering Undergraduate Talent by Unlocking Resources for Education (FUTURE) Act which authorizes a direct data exchange with the Internal Revenue Service (IRS) to facilitate completing the FAFSA form.